Ford Secures Pole Position Among Automakers in Implementing Digital Technologies

William Mansfield

February 4, 2020

Having invested heavily ($500 million) in the Michigan based e-mobility startup, Rivian, and announcing a partnership with Volkswagen to investigate possible collaboration in developing electric vehicles (EVs), Ford is shaping up to be a formidable player in the already fast-growing EV market. It was also reported recently that Lincoln, which is Ford’s luxury car brand, is already developing a new fully electric vehicle in partnership with Rivian set to be released some time in 2022. Ford is sending clear signals to the market that they are ready to tackle the changes that are coming to the automotive industry in the form of digitalization. With the increased adoption of digital technologies by the auto industry set to change the way we drive, Ford is rapidly innovating to come up with safer, cleaner and cheaper modes of transport.

In November 2019, EconSight – a Swiss based consulting and research company, conducted a study of the Top 100 Digital Innovators. This ranking was created using LexisNexis® PatentSight® to analyze patents owned by global companies that are leaders in innovation in the digital space. This study revealed that Ford’s consistent efforts in innovation have resulted in their ranking being improved five spots, within a year. They lead the rank hierarchy in autonomous driving, closely followed by the VW group, Toyota Motor and Bosch.

Following the lead of this study, in order to understand more about technology adoption in the automotive industry, we conducted further analyses – comparing Ford’s portfolio to that of Volkswagen, Alphabet and Apple, who are also active in the automotive space. To maintain consistency, the analysis was limited to patents owned by these companies that relate to a combination of classic and digitalization technologies to be used in automobiles.

How Ford’s technology compares against that of VW, Alphabet and Apple

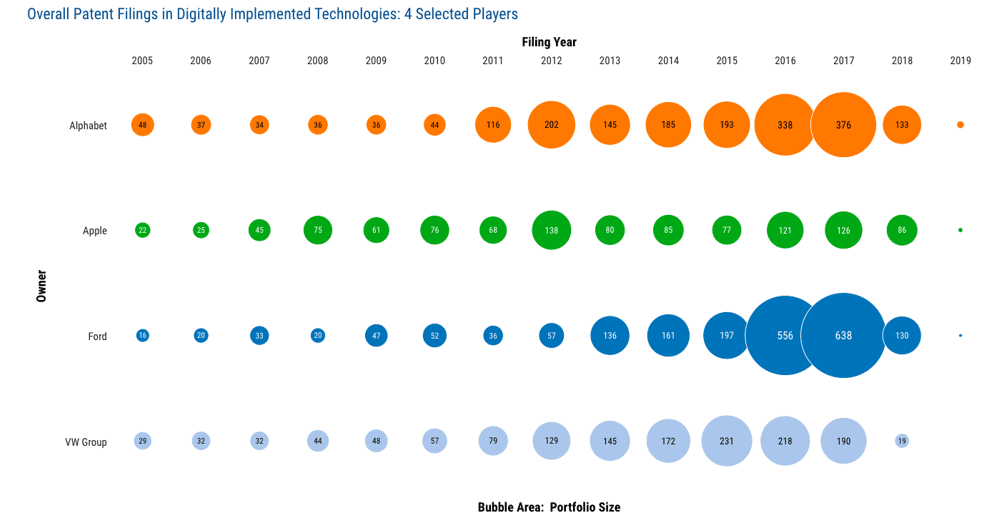

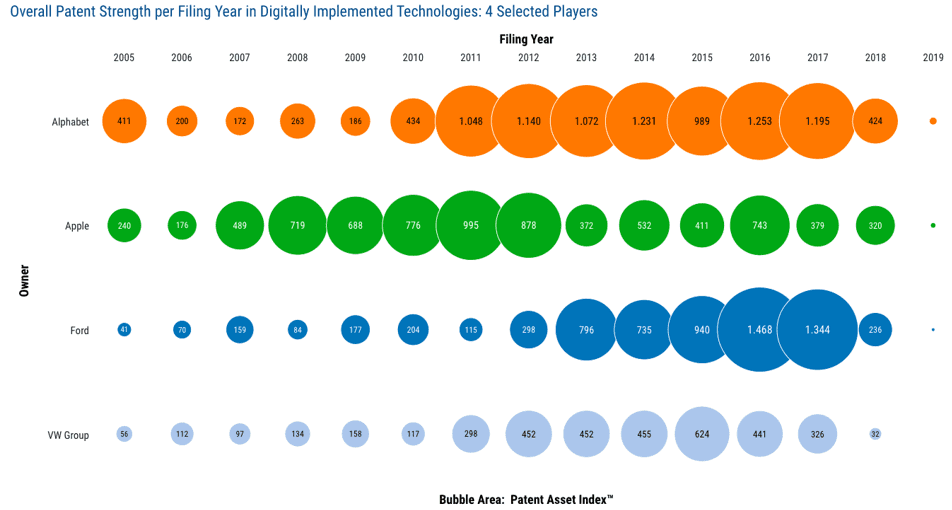

Apart from consistently increasing their portfolio size in digital technologies since 2013, Ford’s patents have also been performing extremely well with regard to the PatentSight overall strength metric, Patent Asset Index. It is visible from both the figures (1 and 2) that Ford has been focused on increasing its foothold in these technologies since 2013. Between 2013 and 2018, for every 2 patents that were filed by Alphabet in these technologies, Ford filed for a little over 3 patents. In the case of Apple and Volkswagen, Ford filed more than 3 times and 2 times as many patents as they did during the same time period.

Figure 1: Patent filing statistics

Figure 2: Overall strength of portfolio

More than 10% of Ford’s ca. 20,000 active patent families, are related to the implementation of digital technologies and have above average Technology Relevance. Alphabet which has the second highest share of such patents within its portfolio, has roughly 6% of its almost 38,000 patent families that fall in this category.

Which technologies within digitalization are Ford superior in?

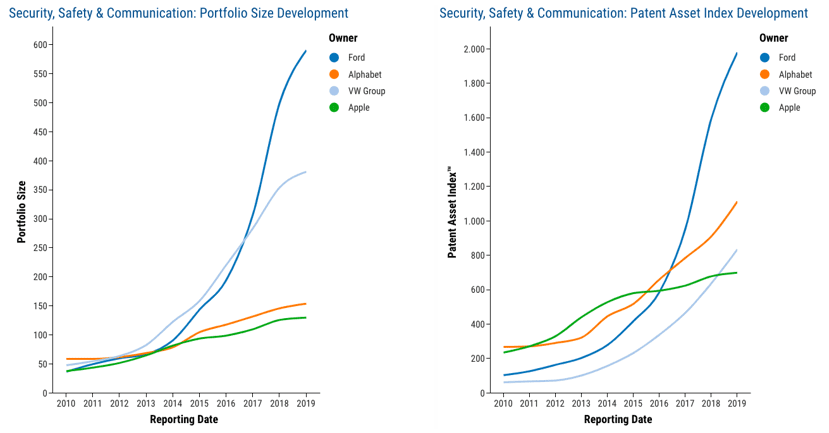

One of Ford’s clear strength areas is security, safety and communication of vehicles and passengers. Technologies that are related to key management, monitoring of driver’s health in autonomous cars and ‘vehicle-to-vehicle’ (V2V) communications. Both in portfolio size and in Patent Asset Index, Ford dominates this sub-technology as compared to the other three companies (figure 3).

Figure 3: Portfolio size and strength trends of patents related to Security, Safety and V2V Communication technologies

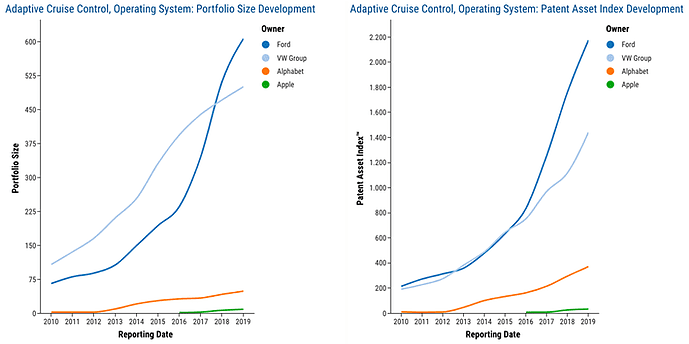

Another area where Ford boasts a stronghold, is in developing the ‘operating system’ of the future vehicle. These are technologies that are related to cruise control, advanced automated driving methods etc. Although Volkswagen almost matches Ford’s level of patenting in this field, the overall strength of its portfolio as indicated by its Patent Asset Index, is quite low in comparison to that of Ford’s portfolio (figure 4).

Figure 4: Portfolio size and strength trends of patents related to Adaptive Cruise Control, Operating System technologies

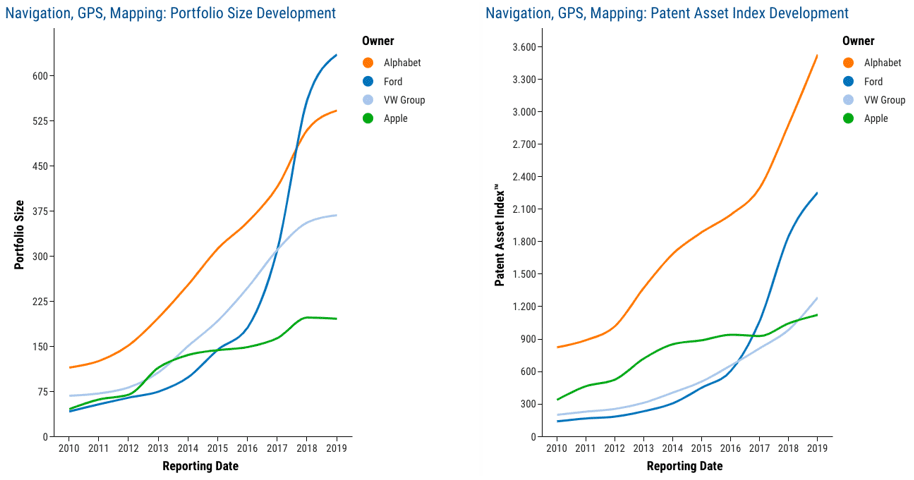

Another important sub-technology within autonomous driving is Navigation, GPS and Mapping technologies. Interestingly here, Alphabet seems to be the front runner. As witnessed in products like Google Maps and its Waymo initiative, Alphabet obviously has the advantage of being the pioneer in this regard. Although in sheer volume, Ford seems to be way ahead of Alphabet in these technologies, a cursory glance at graph on the left (in figure 5) clears all questions as Alphabet’s portfolio has much higher Patent Asset Index as that of Ford or the other 2 companies.

Figure 5: Portfolio size and strength trends of patents related to NAvigation, GPS, Mapping technologies

Key findings from the analysis

One of the most important aspects about Ford’s patenting or technology strategy in autonomous driving, is that they have constantly been ramping up their R&D efforts since the last 5-6 years. Whereas Alphabet’s approach towards this technology, has evolved over a longer period of time, especially in the IT driven aspects such as navigation related technologies. Although not as much as Ford or Alphabet, Volkswagen is also investing in the future of mobility, such as in operating system and in driver assistance technologies.

It seems that Ford is poised to take on the technological battle that is coming to the automotive industry as evidenced by their CEO’s, Jim Hackett, words from last year, when he said that the industry would be revolutionized by both intelligent vehicles and smarter transportation systems. It remains to be seen if going into the future Ford is able to maintain their current pole position or if other partnerships/amalgamations of companies are formed that can ‘overtake’ Ford.

Learn more about PatentSight and the Patent Asset Index.

Excellent data quality is the foundation of reliable analyses. Learn how PatentSight enhances patent data here.

About the author: William Mansfield

William is the Head of Consulting and Customer Success for LexisNexis PatentSight. Responsible for overseeing the negotiation, creation, and delivery of PatentSight’s global consulting work along with managing the Customer Success team.