5G and SEP Benchmark: Updated

William Mansfield

6/24/2020

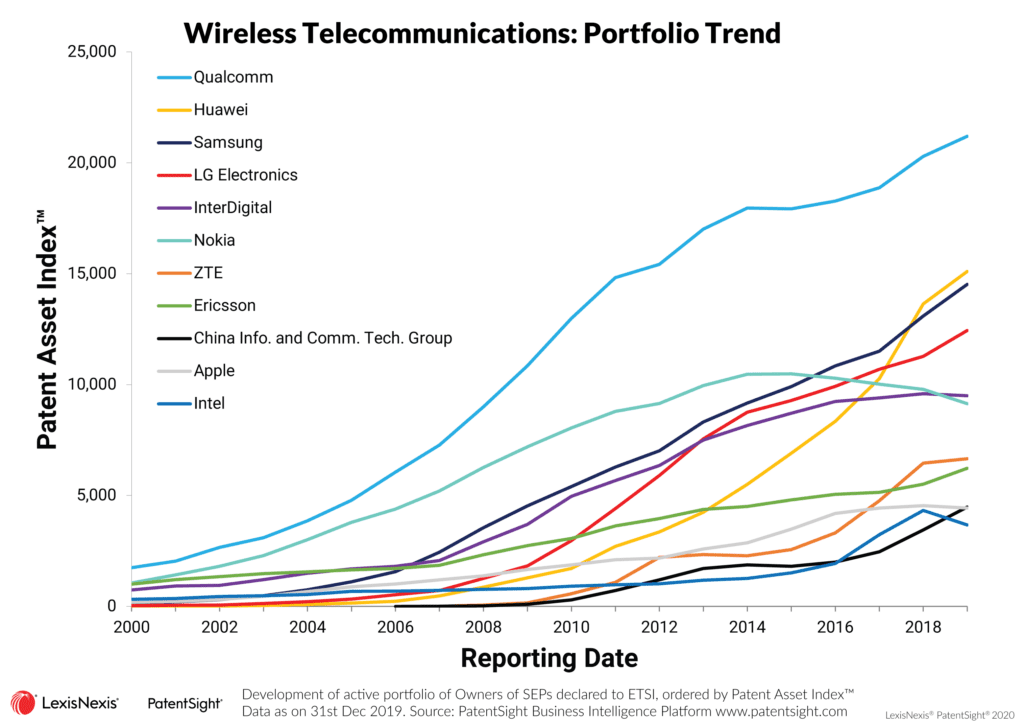

We explore the status and development of the competitive positioning with the arena of modern wireless telecommunications, through the lens of Standard Essential Patent (SEP) declarations to ETSI. The guiding topic is the acquisition of Intel’s modem business by Apple. A year on and not only has that transfer of assets taken place, but also time has marched on and further developments in the field have also been made. So, it is time to revisit this analysis and see the status as of 2020.

We can see Intel has dropped off the bottom of the pack, being at #7 last time we checked, and now included at #11. In these analyses we reflect the owner as of today, so the full history of development of the Intel modem business has been transferred to Apple along with the assets. Hence, we can see Apple jump a number of places, being outside the top 10 in last years analysis, and this year just being inside at #10. China Information and Communication Technologies Group Corporation (CICT) has snuck in with recent publications to just beat Apple to the #9 spot.

Huawei, whilst jumping a number of places from effectively zero in the early 2000s, beyond InterDigital, Nokia, LG, and Samsung to #2 today. Certainly, impressive growth, but still some way away from the #1 spot.

Remaining with the Asian players, Samsung are now #3 but have moved away a little more from their country-mate, LG. The trend for all these Asian players is steep, and climbing away from the bottom half of the top 10.

Finally, Qualcomm remains in the #1 spot. Their early development and continued innovation in the space has made them the undisputed leader in terms of their Patent Asset Index. Qualcomm do not have largest portfolio out of the top 10, this does go to Huawei, however simply counting the number of patents is an ineffective measure of the strength of a portfolio.

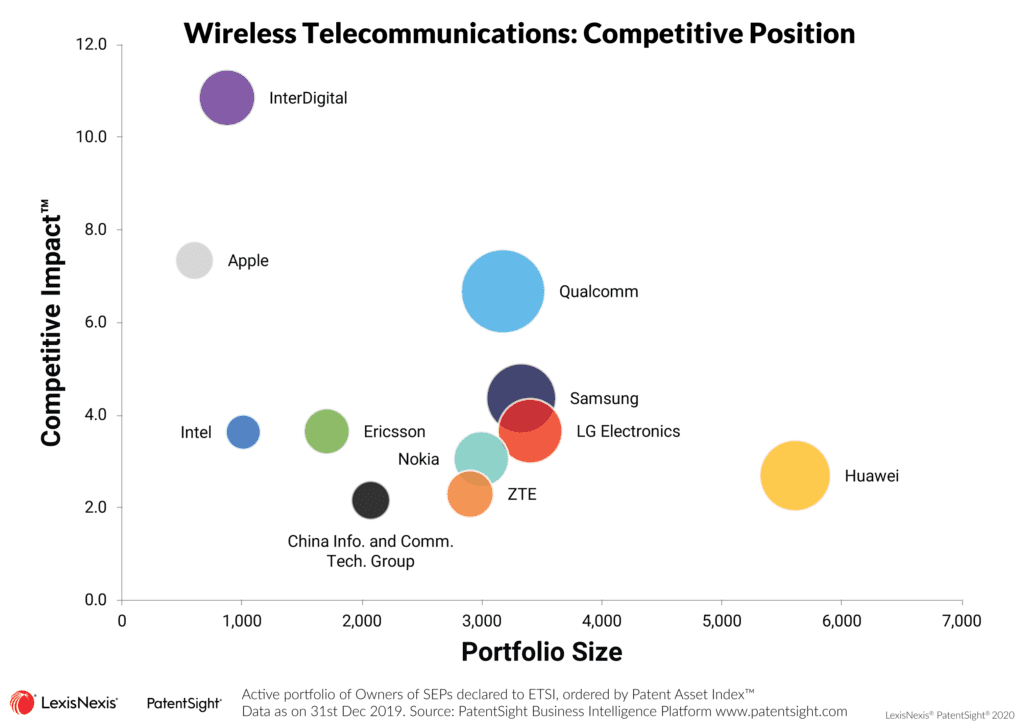

Looking at the breakdown of the LexisNexis® PatentSight® Patent Asset Index into its component parts, the Portfolio Size and the Competitive Impact, we can drill-in to understand the strategic position of these players.

Here, again, we can identify Qualcomm’s lead, with the largest bubble in the middle of the analysis. Likewise, we can see Huawei with more patents, but with a lower Competitive Impact on average. Huawei’s Competitive Impact of around 3 is still well above the global average of 1, but well below Qualcomm at around 7.

We can also see the high-quality assets from InterDigital and, now also Apple. InterDigital’s business model is licensing, so each patent needs to be an asset which pays for itself, as such only those of the highest quality are maintained. Companies with more typical operations, like most of the others in the analysis, also likely use their portfolio for strategic protection, so have some less valuable assets to facilitate this.

Then at the end, Apple, the focus of our original analysis one year ago. They now have a surprisingly high quality portfolio, albeit small, the smallest of the top 10. Intel did not have much luck in this arena in the past, hence the sale of the assets which Reuters reported to be at a multi-billion dollar loss. Time will tell if Apple is able to build out it’s portfolio and technical expertise in a way Intel was unable to do, and really be considered to have a seat at the 5G table.

Learn more about PatentSight and the Patent Asset Index.

See how to use the Patent Asset Index for patent portfolio benchmarking.

About the author: William Mansfield

William is the Head of Consulting and Customer Success for LexisNexis PatentSight. Responsible for overseeing the negotiation, creation, and delivery of PatentSight’s global consulting work along with managing the Customer Success team.